Share this Image On Your Site

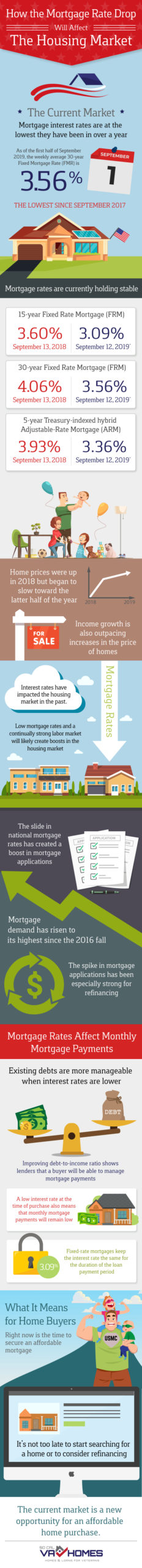

The Current Market:

Mortgage interest rates are at the lowest they have been in over a year.

As of the first half of September 2019, the weekly average 30-year Fixed Mortgage Rate (FMR) is 3.56%, the lowest since September 2017.

Mortgage rates are currently holding stable.

Rates one year ago (on September 13, 2018):

- 15-year Fixed-Rate Mortgage (FRM) was 3.60%

- 30-year FRM was 4.06%

- 5-year Treasury-indexed hybrid Adjustable-Rate Mortgage (ARM) was 3.93%

Current rates (as of September 12, 2019):

- 15-year Fixed-Rate Mortgage (FRM) is 3.09%.

- 30-year FRM is 3.56%

- 5-year Treasury-indexed hybrid Adjustable-Rate Mortgage (ARM) is 3.36%.

Home prices were up in 2018 but began to slow toward the latter half of the year.

Income growth is also outpacing increases in the price of homes.

Interest rates have impacted the housing market in the past.

Low mortgage rates and a continually strong labor market will likely create boosts in the housing market.

The slide in national mortgage rates has created a boost in mortgage applications.

Mortgage demand has risen to its highest since the 2016 fall.

The spike in mortgage applications has been especially strong for refinancing.

Mortgage Rates Affect Monthly Mortgage Payments

Existing debts are more manageable when interest rates are lower.

Improving the debt-to-income ratio shows lenders that a buyer will be able to manage mortgage payments.

A low-interest rate at the time of purchase also means that monthly mortgage payments will remain low.

Fixed-rate mortgages keep the interest rate the same for the duration of the loan payment period.

What It Means for Home Buyers:

Right now is the time to secure an affordable mortgage.

It’s not too late to start searching for a home or to consider refinancing.

The current market is a new opportunity for an affordable home purchase.