CalVet Home Loan vs VA home loan

Va Loans

REAL ESTATE FOR VETERANS

The CalVet Home Loan

Peter Van Brady

Founder of SoCal VA Homes

Author: Avoiding Mistakes & Crushing Your Deals Using Your VA Loan

Since 1921, the CalVet home loan program has been useful for some Veterans looking to purchase a home in California, but CalVet's loan volume is absolutely dwarfed by traditional VA home loan volume in California. Find out why right here.

This page provides a ton of information, including a comparison of the CalVet and VA home loan. What are the advantages & drawbacks of the CalVet home loan vs. VA home loan?

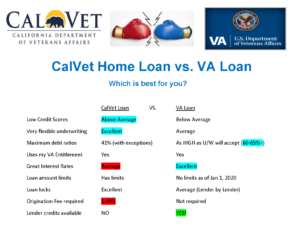

The snapshot below highlights comparisons of CalVet and VA home loan requirements & interest rates, which are explained in deep detail in the video.

In the video, we reveal some insider secrets at the end - information about VA Loan interest rates that is rarely if ever discussed with borrowers by our industry.

This video explains everything you need to know about CalVet and VA home loans:

What is CalVet?

What is CalVet?

The California Department of Veterans Affairs, or CalVet, is a state agency dedicated to providing a wide range of resources for California Veterans and their families. With over 1.8 million Veterans — and an additional 30,000 military personnel discharged every year — California has more retired service members than any other state. Resources offered by CalVet include education, employment, healthcare, and housing benefits. They can also connect Veterans with additional resources offered through the United States Department of Veterans Affairs (USDVA).

Am I Eligible for a CalVet Loan?

Am I Eligible for a CalVet Loan?

Qualifying Veterans are included into one of two groups, because of the way the CalVet home loans are financed by selling bonds.

Veterans who served during a qualifying war period or received an armed forces expeditionary medal or campaign medal awarded by the federal government, for the period served, qualify under what’s known as the Qualified Veterans Mortgage Bond Program or QVMB. If you fall into this group, the CalVet loan office requires that they receive your loan application within twenty-five years from your active duty discharge date. Under the CalVet QVMB loan requirements, there are no property purchase price restrictions or income limits placed on borrowers, such as exist with other programs.

All Veterans and current members of the California National Guard or U.S. Military Reserves qualify under the Qualified Mortgage Bond Program or QMB. This is slightly different from the above QVMB program. If you fall into this category, you can only buy a property that meets certain criteria, as discussed below. Additionally, the QMB funds are usually limited to home buyers who have not owned their principle residence in the past three years.

If you’ve already used your CalVet home loan benefits in the past, you are free to use them again. There is no limit to the number of times you can apply for a CalVet home loan. Note that you can only have one active loan at a time.

How Does The CalVet Home Loan Program Work?

How Does The CalVet Home Loan Program Work?

Since 1921, CalVet Home Loan program has been funding CalVet loans for an ever climbing number of California Veterans. Again, the source of the funds come from the QVMBs & QMBs. These are periodically voter-approved bonds, backed by the state of California and used to supply qualified Veterans in the state with home and farm loan benefits. These loan benefits include low-interest rates, low costs and manual underwriting. This means that each application is personally reviewed by an underwriter.

In addition, CalVet loans generally come with superior quality insurance, including fire, hazard, flood, and earthquake coverage with low deductibles. Finally, the program boasts the highest level of service in the industry, offering “speed in closing, clear lines of communication, and a positive ‘customer service’ attitude,” according to reviews.

These loans can only be used for properties in California.

However, because the voter-approved bond is issued at a specific “coupon rate” (the rate offered to the bond investor), there is a "lag time" in this system of supply (the bond issuance) and the demand (the Veterans borrowing the money). It takes a while to exhaust the supply of funds raised by the bond issuance. As a result, in a declining interest rate market, CalVet rates can be higher than traditional VA loan rates. The opposite can also be true.

It is also important to note that for Veterans who qualify for the QMB funds, your purchase price for your home in Non-Targeted areas cannot exceed 90% of the average value for the area that the property is located in, and cannot exceed 110% of the average value of properties located in Targeted areas. These areas are defined by the federal government census tract designations.

Lastly, Cal Vet Home Loan Eligibility Requirements for current members of the California National Guard or U.S. Military Reserves who served a minimum of one year of a six-year commitment, may qualify to receive a loan from QMB funds, if qualified under One of the following two categories:

-

-

-

- You must be considered a first time buyer, which is defined as not owning a principal residence in the last three years.

- You must purchase a home in the Targeted area.

-

-

Finally, don’t worry about your Certificate of Eligibility (COE), as the Cal Vet Home Loan qualifying administrator will pull it for you on your first call-in to their office. Or we can pull it for you as well from the VA Portal.

Advantages and Disadvantages of The CalVet Home Loan Program

Advantages and Disadvantages of The CalVet Home Loan Program

People often call SoCal VA Homes inquiring about the CalVet loan, wondering if it might be a good fit for them. Our answer is it might be (if they are active military or a Veteran and a California resident). There are both PROS & CONS to CalVet loans. In a few isolated circumstances, a CalVet loan may be preferable to a traditional VA Home Loan. We will compare and contrast their features and benefits.

CalVet Loan Limits 2020, 2021 & 2022

CalVet Loan Limits 2020, 2021 & 2022

An advantage of the CalVet loan might be the loan limit, depending on the amount of your financing needs. CalVet loan limits are offered at 125% of the FNMA loan limits, which are also the VA loan limits.

HOWEVER, after the passage of the Blue Water Navy Vietnam Veterans Act of 2019, current VA loan limits are less of little concern. California Veterans can now borrow 100% of the value of the home up to the lender's maximum, often 1.5MM, but SoCal VAHomes has VA loan limits which can exceed $2,500,000! That's a BIG VA loan!

Before January 01, 2020, loan limits were a big concern.

Again, the Blue Water Navy bill changed everything regarding loan limits.

In the past, CalVet had a loan limit of $521,250. That's significantly higher than the VA conforming loan limit of $417,000 throughout the state. California has a lot of “high-cost” communities where the county loan limit has been much higher than $417,000. A few years ago, in Alameda, Marin, and other select counties, the Department of Veterans Affairs, not CalVet, was actually approving 100% financing in these counties up to a million dollars. In the counties where high-cost loan limits don’t exist, CalVet financing may be an advantage to the extent that your purchase needs 100% financing.

If you are purchasing a home in a county that does not have a high-cost limit (the loan limit is $417,000), and you want to buy a more expensive property, a “small” down payment will be required for a traditional VA home loan. The VA is going to ask that you cover that 25% guaranty or contribute 25% of the difference between the purchase price and the VA loan limit, which is $417,000 in counties without the high-cost designation. If the difference is small, you may want to find a way to come up with the extra cash and choose a traditional VA home loan. But if you just absolutely have to have 100% financing, then CalVet might be an option for you because of that higher loan limit of $521,250.

CalVet Loan Requirements

CalVet Loan Requirements

Credit Requirements:

CalVet loan credit requirements are much more lenient on their review of a Veteran's credit profile. This makes it much easier on those borrowers who have had serious credit troubles. In CalVet’s case, all of the underwriting is done “old-school,” via manual underwriting. Manual underwriting is when a human (not a computer) initially reviews your loan application. With CalVet, underwriters are instructed to be more flexible when considering derogatory credit.

However, manual underwriting can also work to your advantage with a traditional VA underwriter. Traditional VA financing with manual underwriting may accept credit scores as low as 580 or even lower, but the lender will adjust the “price” of the loan (the interest rate and points) to accordingly reflect the greater default risk associated with the lower scores. Considering CalVet has one “price” to fit all borrowers, CalVet could be considered more of a last resort option when considering credit. CalVet rates and fees are a comparative disadvantage.

If you have had bankruptcies, foreclosures and/or lots of collection accounts and charge-offs, but you are now financially stable, CalVet's manual underwriting strategy may suit your needs. CalVet is not “credit-score-driven,” per se, and that can be an advantage. For those borrowers who are at the very lowest end of the credit spectrum, CalVet may be your only option.

From a credit standpoint, CalVet loan requirements are as minimal as it gets! Yet, our advice is to explore all traditional VA financing options first before inquiring about a CalVet loan.

Income and Debt Ratio Requirements:

CalVet loan requirements for income and debt ratios can unfortunately be very stringent. Again because these loans are manually underwritten, their underwriters are going to subscribe to the traditional debt ratios of 41%. You're not being penalized. Think of it this way: if the biggest advantage of the CAlVet loan is allowing more derogatory credit than traditional VA underwriting, then the guidelines have to "reel it back in" with regard to stretching debt ratios. It's a give and take to make the loan approval work. CalVet loan requirements for debt rations have to be conservative or the default numbers climb too high and investors stop buying the bonds that fund the program.

Mobile Homes

Mobile Homes

If you wish to buy a mobile home, then CalVet will perform financing on mobile homes when you intend to rent the space to place the home on. These spaces are commonly in mobile home parks. These are not considered real estate loans. These are consumer loans because there is no “real property.” In this case, you can load the home on a trailer and drive it away. That’s not considered “real estate,” or real property. In the typical world of real estate lending, that type of consumer financing doesn't exist because the mobile home is not on a fixed foundation; it’s not attached to the earth! If you are looking for that type of residential living, CalVet presents an obvious advantage. In 2015, CalVet required a down payment. A 6-1/2% down payment would allow purchase prices up to $175,000. That’s a lot of buying power for a mobile home purchase.

CalVet Loan Rates

CalVet Loan Rates

CalVet's home loan interest rates are very often HIGHER than typical VA rates, as you'll easily see. SoCal VA Homes VA home loan rates are always much LOWER than the industry average for VA rates...

Today’s industry average rate from Nerd Wallet for a VA 30-Year Fixed Rate is: %

When you call us at 949-268-7742 for a rate quote, you'll easily be convinced...give us a call for your specific rate quote!

To achieve the rate that we offer through CalVet, CalVet requires a 1% origination fee, without exception. That fee on 1.00% of the loan balance needs to be paid to CalVet before closing. Therefore, an immediate price comparison would reveal the price of the CalVet loan as appearing to be more expensive. That's the only fee they charge.

In typical VA financing, that 1% origination fee can easily disappear. Understanding “loan pricing,” and how that 1.00% disappears is very valuable. There is a big difference in the mechanics of the moving parts of where CalVet gets its money to lend vs. where the funds come from when a traditional VA lender makes a loan to you.

With CalVet, the money to lend is created from selling “California bonds” to investors before you apply for a loan. The investors are promised a specific yield or rate of return on their investment based on current market conditions. When those funds raised from investors are exhausted, the program sells a new block of bonds in the same manner, likely at a different rate as market forces dictate. CalVet has more than one program. Let's imagine there are one hundred million dollars available to lend for one CalVet program and a hundred million dollars for another CalVet program. The interest rates on these mortgage programs go up and down as funds are loaned to borrowers and then new rounds of bonds are sold to investors. And in most interest rate environments, the CalVet rates are going to be higher than typical VA rates.

The CalVet system and “cycle” of raising funds, then lending those funds appear archaic as compared to the “real-time” functioning of traditional mortgage banking. The system that traditional lenders use when selling VA loans “to the secondary market” or “GNMA” is far more efficient and responsive to the daily change in interest rates. This traditional system typically creates lower rates with expanded choices for different interest rates. And those choices can create advantages when addressing your closing costs.

A Disadvantage: CalVet does not have the ability to offset your closing costs.

A Disadvantage: CalVet does not have the ability to offset your closing costs.

Let's examine what happens in a “seller's” market. Due to The Great Recession, California had the lowest inventory of homes available for sale in the Golden State in fifteen years. After the "melt-down,", all the first-time buyers came out of the woodwork at the same time. The renewed buyer demand and investors both helped to bid up prices. The result was that there weren't many homes for sale! It was a very tight market. And in tight markets, sellers are not inclined to give buyers any concessions for closing costs. The attitude is, “Here's the property as-is. Buy it at this full list price or higher or get out of the way of the next ten offers! We’re not giving away any credit towards closing costs or repairs or anything else!”

Here's when it gets really, really difficult with CalVet. If CalVet is the only option that will work for you, then be prepared to pay your own closing costs. When constructing what's described in the industry as a "VA no-no", a no-money-down-no-closing-costs purchase, the closing costs do exist and have to be paid somehow. And in that “VA no-no” scenario, closing costs will be paid for by one of two parties: the seller or the lender. In a tight market, the seller is NOT going to pay for them, and these costs can be substantial.

If you don't have any money and the seller is not going to pay for the closing costs, who’s going to pay the 1% origination fee charged by CalVet? Who’s going to pay for the appraisal, title, and escrow fees? Who’s going to contribute the funds to the new “impound account,” to budget for taxes and insurance? Someone's got to pay for all this! The seller's not going to pay for it, you don't have any money, and CalVet won’t pay for it, so you are out of luck. With traditional VA financing, interest rate choices should exist to solve this problem. It’s very common for VA borrowers to consider a higher interest rate option (than the lowest rates offered) where the lender pays for all of the closing costs. These options are a function of a complex capital market for mortgages.

In 1977, Lewis Ranieri of Solomon Brothers created the advent of “mortgage-backed securities.” As a result, today there is a spectrum of interest rates available in the mortgage marketplace. The lowest rates, where you pay “points,” are very costly. With the highest rate choices, the lender contributes funds available for closing costs. For an expanded discussion of how this works, please refer to the chapter on VA IRRRLs.

Imagine interest rates offered in a range between 3.25% and 4.25%. That interest rate spectrum allows you choices. At the highest rate of 4.25%, the lender can inject cash into the transaction to pay for all the closing costs including underwriting, title, appraisal, escrow, funding the new impound account, (months of property tax liabilities and home owner’s insurance.) This can be very advantageous because closing costs can easily add up to more than $10,000.00. This is the mechanism of how costs typically get paid for in a VA purchase transaction.

Of course, the opposite choice is also always available. Think of this choice as "buying points" or a "buy-down" as it commonly referred to. You (or the seller) contribute funds to buy down the rate in this case to 3.25%. Hopefully, whoever you're talking with to arrange your financing presents you with these valuable options. You do have choices.

In conclusion, from the loan “pricing” perspective or the availability of interest rate choices, Cal Vet represents a big disadvantage, whereas traditional VA financing offers choices that represent a huge advantage.

Get a CalVet Home Loan and VA Home Loan at SoCal VA Homes

Get a CalVet Home Loan and VA Home Loan at SoCal VA Homes

We'll help you determine which financing option is best for you! We offer both a CalVet and a VA home loan as well. In most cases, a traditional VA loan may be the best choice. If this is your situation, you'll want to find out id you meet the VA loan requirements. Call us today at (949) 268-7742

As Seen on ABC 10 5:00 O’Clock News