VA Loan Eligibility And Requirements

Va Loans

REAL ESTATE FOR VETERANS

Author: Avoiding Mistakes & Crushing Your Deals Using Your VA LoanPeter Van Brady

Founder of SoCal VA Homes

Learn what's required to qualify for a VA loan and how to get the process started.

VA loans come with many perks (ahem, no down payment or private mortgage insurance required). If you can qualify, they're usually the best way to go. However, not everyone is eligible. VA loans are designed for qualifying U.S. servicemembers, veterans, and surviving spouses.

Here's a closer look at all you need to know about the VA loan requirements. Plus, learn the basics about getting a certificate of eligibility (COE) and starting the VA loan process.

What Are The VA Loan Requirements?

VA loans are primarily designed for service members, veterans, and surviving spouses. However, if you fall under one of those categories, you won't automatically qualify. As an applicant, you’ll also need to meet the minimum service requirement and have earned an honorable discharge — unless you qualify for an exception. Read on to learn more about each of the VA loan eligibility requirements.

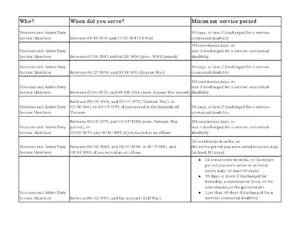

VA loan minimum service requirements

To qualify for the VA loan program, you’ll need to meet the following minimum service requirements:

- 90 consecutive days of active service during wartime.

- 181 days of active service during peacetime.

- More than 6 years of service in the National Guard or Reserves.

Here's a closer look at the minimum service requirements by service period:

Exceptions to the minimum service requirements

If you don't meet the minimum service requirement for the time you served, there's still a chance you can qualify. Exceptions are made if you were discharged for an eligible reason, including:

- A service-connected disability

- Reduction in force

- Early out when you've served at least 21 months of a two-year enlistment

- Hardship

- Government convenience after serving at least 20 months of a two-year enlistment

- Certain medical conditions

Honorable discharge requirement

The Department of Veterans Affairs also typically requires you to have received an honorable discharge from the service to qualify for VA loan benefits.

Exceptions to the Honorable Discharge Requirement

That said, if you didn't receive an honorable discharge, you may still qualify for VA loan benefits by applying for a discharge upgrade or undergoing the Character of Discharge review process.

If your discharge status was connected to a mental health condition (including PTSD), sexual assault, sexual harassment, or sexual orientation, you'll typically have a good chance of getting a discharge upgrade.

Alternatively, the Character of Discharge review process involves a review of your discharge to determine if it's considered "honorable for VA purposes." If it is, you'll be eligible. Unfortunately, it can take up to a year and may require you to hire someone to advocate on your behalf.

Surviving spouses

Surviving spouses of Veterans who are missing in action, held as prisoners of war, or who have passed away can also apply for a VA certificate of eligibility.

Note, if your spouse passed away while in the service or from a service-related disability, you can't have remarried before you were 57 years old or before December 16, 2003 (unless your spouse was totally disabled before passing away).

Other qualifying situations

VA loan eligibility also extends a bit further. You might be able to qualify if you served as a member of a certain organization, such as a:

- Public Health Service Officer

- Cadet at the U.S. Military, Air Force, or Coast Guard Academy

- Midshipman at the U.S. Naval Academy

- Merchant Seaman during World War 2

- Officer of the National Oceanic & Atmospheric Administration

You can also qualify if you are a U.S. citizen who served in the Armed Forces of another government that was allied with the U.S. in World War 2.

Minimum credit score requirement

VA loans are more flexible than many other types of home loans. There is no minimum credit score requirement or maximum debt ratio rule. Instead, the VA requires lenders to review the credit profile of the applicant and ensure they can afford the loan.

Confirm Your VA Loan Eligibility

Before getting a VA loan, you’re going to need a Certificate of Eligibility (COE) to verify that you meet all the necessary requirements.

You can get your COE directly from the VA or from some lenders. For example, at So Cal VA Homes, we specialize in VA loans and have access to the ACE (Automated Certificate of Eligibility) system. This Internet-based application allows us to establish eligibility and issue an online Certificate of Eligibility in a matter of seconds.

If we cannot get your COE electronically for some reason, we can help you get it with the proper documents found below.

Prove your eligibility to obtain a VA loan

When you need to prove your VA loan eligibility, here’s the paperwork that will be required depending on your situation.

Veteran: DD Form 214 with a copy showing the character of service (item 24) and the narrative reason for separation (item 28).

Current or former National Guard or Reserve member who has been activated Federal active service: DD Form 214 showing the character of service (item 24) and the narrative reason for separation (item 28).

Active Duty Service Member: A current statement of service signed by the adjutant, personnel office, or commander of the unit or higher headquarters. It needs to show the name, social security number, birthdate, duration of any lost time, name of the command who provides the information, and the entry date of active duty.

Current National Guard or Reserve member who hasn’t been Federal active service: A current statement of service signed by the adjutant, personnel office, or commander of the unit or higher headquarters. It must show your name, social security number, birthdate, entry date on duty, name of the command providing information, and the duration of any lost time.

Discharged National Guard member who hasn’t been activated for Federal active service: NGB Form 22, Report of Separation and Record of Service for each period of National Guard service-OR-NGB Form 23, Retirement Points Accounting, and proof of the character of service

Discharged Selected Reserve members who haven’t been activated for Federal active service: Proof of honorable service and a copy of your more recent annual retirement points statement.

Surviving spouses receiving Dependency & Indemnity Compensation benefits: VA form 26-1817 and veteran’s DD214 ( if available).

Surviving spouses not receiving Dependency & Indemnity Compensation benefits: VA Form 21-534, DD214 (if available), Marriage License, and Death Certificate or DD Form 1300 – Report of Casualty.

What happens once you’re eligible for VA loans?

Once you get your Certificate of Eligibility for a VA loan, you can talk with a lender like So Cal VA Homes about the details of your loan and how it will work. We’ll help you understand the loan amount you can get, your VA loan rates and mortgage payment amount, the funding fee cost, and more. Then, all that's left is finding the perfect place to call home!

We'll help you get your Certificate of Eligibility (COE) ASAP!

Ready to verify your eligibility for a VA loan? Once you have the documents needed for your COE, call the team at So Cal VA Homes! We’ll expedite the qualification process for you!

Contact us today at (949) 268-7742 to get your Certificate of Eligibility and get started!

As Seen on ABC 10 5:00 O’Clock News